Tax season is just around the corner, and that means it’s time to start getting prepared! In this blog post, we will discuss some tips that will help make the process a little bit easier. Whether you are a first-time tax filer or have been doing your taxes for years, there are always new things to learn. So, let’s get started!

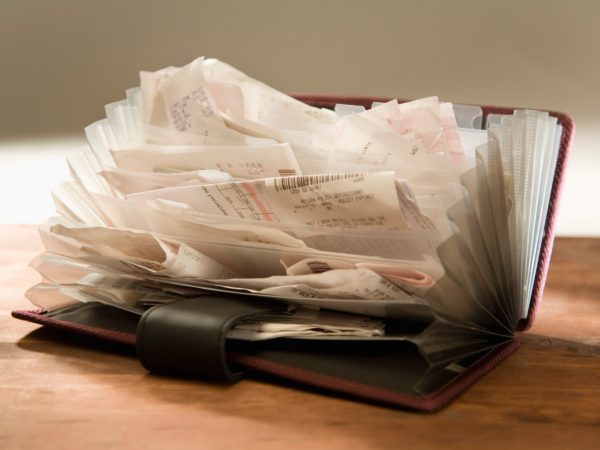

Organize Your Receipts

One of the most important things to do when preparing for tax season is to gather all of your documents. This includes receipts, T slips, and any other information that you will need to file your taxes. Make sure to keep these documents organized and easy to access, so that you can find what you need quickly.

One of the most important things to do when preparing for tax season is to gather all of your documents. This includes receipts, T slips, and any other information that you will need to file your taxes. Make sure to keep these documents organized and easy to access, so that you can find what you need quickly.

Stay Up-To-Date On Tax Laws

Another thing to keep in mind is that tax laws change every year, so it’s important to stay up-to-date on the latest changes. The Canada Revenue Agency (CRA) offers a number of resources to help taxpayers do this, including online tools and publications. You can also contact the CRA directly if you have any questions.

Choose A Filing Option

When it comes to filing your tax return, there are a few different options to choose from. You can file electronically or by paper, and you can also use a tax preparer or software. Electronic filing is the most common method, and it’s quick and easy. You can find more information about electronic filing on the CRA website.

When it comes to filing your tax return, there are a few different options to choose from. You can file electronically or by paper, and you can also use a tax preparer or software. Electronic filing is the most common method, and it’s quick and easy. You can find more information about electronic filing on the CRA website.

If you do decide to file electronically, make sure to have a copy of your tax return for future reference. The CRA also recommends that you keep all of your tax records for six years after the end of the tax year in question.

Tax season can be stressful, but with these tips it doesn’t have to be! Follow these guidelines and you will be on your way to a stress-free tax season.